Launch of Hunting 2030 strategy & Capital Markets Day

Hunting PLC (LSE:HTG), the international energy services group with proven capabilities for energy and beyond, today announces the launch of the Hunting 2030 strategy, a broad-based strategy to grow and evolve the company through the remainder of the decade and beyond.

Hunting PLC

(“Hunting” or the “Company” or the “Group”)

The highlights of the Hunting 2030 Strategy are detailed below and will be expanded upon at a Capital Markets Day to be hosted in September 2023.

Strategic Highlights

Continue to capitalise on Hunting’s proven capabilities in energy services;

Stimulate further growth, rebuild baseload earnings and stabilise profitability:

Supported by the strong outlook for global oil and gas sales (North America, Europe, Middle East and Asia Pacific);

Furthered through diversifying revenue across non-oil and gas sub-sectors where the Group can leverage existing expertise;

Delivered through both organic and inorganic growth opportunities;

Resulting in a long-term EBITDA margin target of 15%; and

Sustainable and growing dividend policy targeting an average increase of c.10% per annum until the end of 2030.

“The Board has set a targeted medium-term strategy that derives revenue from a wider range of sectors including oil and gas, as well as the wider energy industry and other sectors requiring precision engineering and systems design, supported by the Group’s proprietary technology and sector leading expertise. This strategy will stimulate new growth and rebuild a baseload of earnings to establish greater resilience to the cyclicality of the oil and gas industry, which will in turn lead to more stable earnings and increased investment returns in the medium term."

“The evolution of the Group’s strategy is underpinned by its established position as a manufacturer of world-class precision engineered products across multiple sectors and the belief that Hunting can achieve strong organic growth within existing and complementary sectors through an enhanced strategic focus on compelling growth markets that lend themselves to Hunting’s existing expertise.”

Strategic Initiatives

Continued focus on precision engineering to service the global oil and gas market

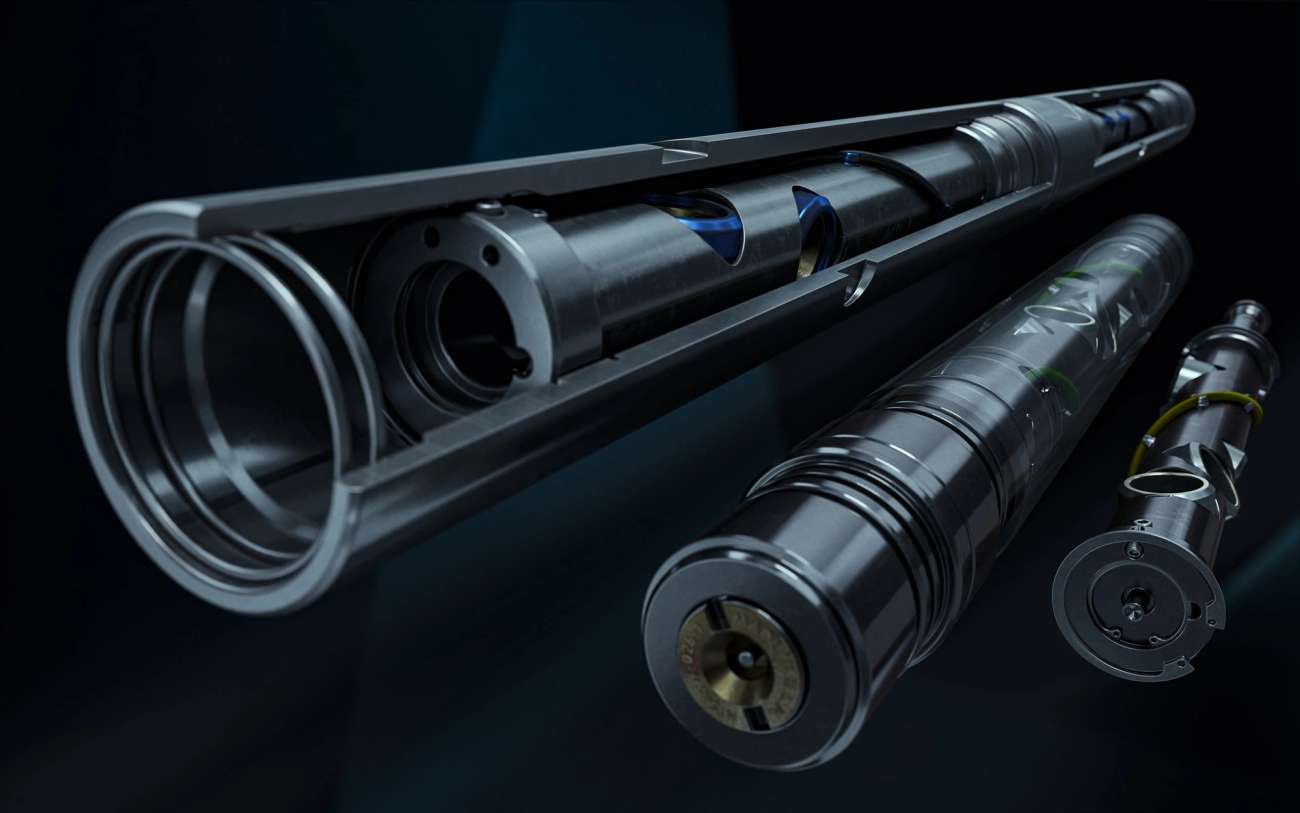

Primary focus remains on the manufacturing of high-value, energy services’ products and technology for Hunting’s core oil and gas market; of which

Premium connections, OCTG, accessories manufacturing and well intervention tools will underpin revenue and profitability over the short and medium term, driven by a continued focus on domestic and regional energy security and following years of material underinvestment in oil and gas production;

Cash flows from core operations will fund new investments in both the oil and gas sector as well as wider opportunities.

Strategic Initiatives

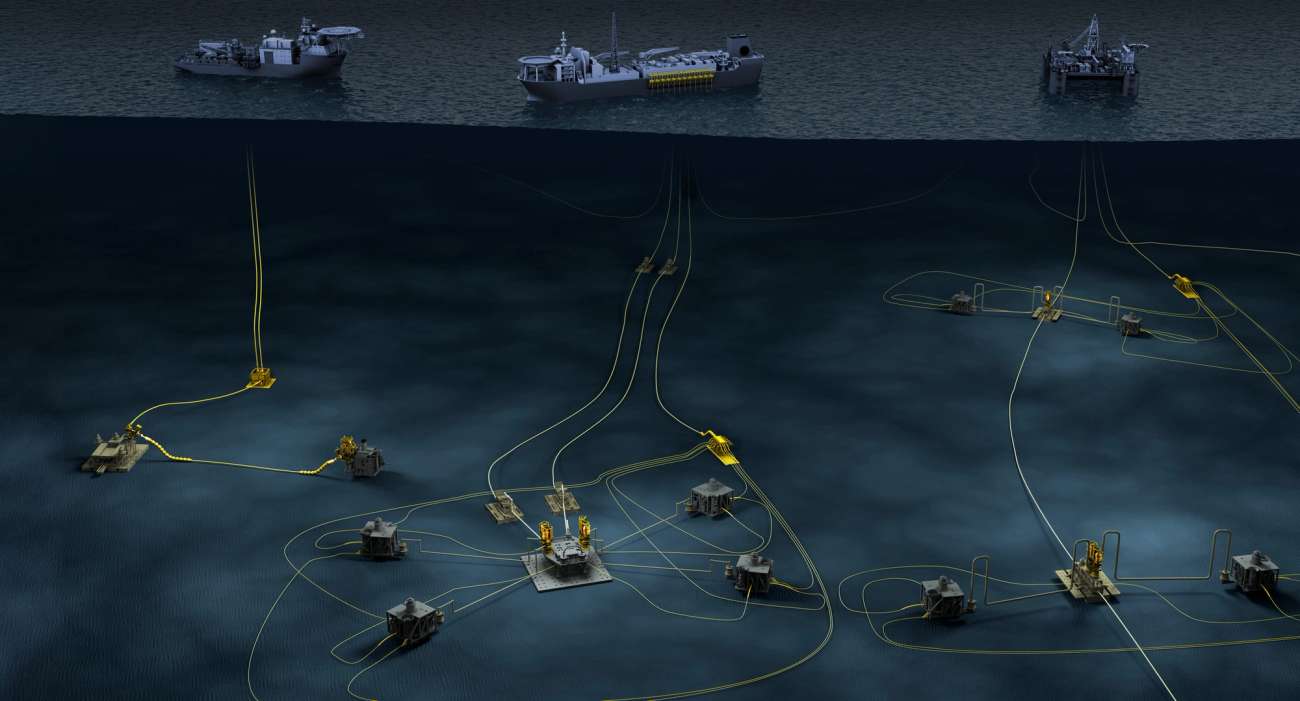

Growth of Subsea Technologies operating segment

Subsea Technologies growth to be achieved both organically and inorganically;

Since 2009, the Company has acquired a number of key businesses:

National Coupling Company – a key supplier of hydraulic valves and couplings to deep water projects;

RTI Energy Services – a manufacturer of titanium and steel stress joints, which are applied to FPSOs; and

Enpro Subsea – a developer of modular deep water production and intervention equipment.

These businesses form Hunting’s core Subsea Technologies offering;

The Group is also focusing on new opportunities across the energy transition, plug and abandonment and integrated subsea systems sectors.

Strategic Initiatives

Development of Energy Transition market position

Establishment of Energy Transition sales group previously announced in December 2022;

Strategic focus on cultivating a material revenue stream from the emerging opportunities within the geothermal and carbon capture and storage sectors;

Near and medium term growth opportunities in Asia Pacific and North America, where a significant number of developments have been sanctioned.

Strategic Initiatives

Continued development of non-oil and gas revenue

Continued diversification within Hunting’s Advanced Manufacturing business, leveraging its expertise in precision engineering and specialist electronics;

Both the Dearborn and Electronics businesses have grown their respective order books over the past 12 months (>$121m with >$40m from non-oil and gas sectors in areas such as defence and aerospace);

Anticipate further material growth from our existing business, supplemented by targeted inorganic growth.

Notice of Capital Markets Day

Hunting will present the details of the Hunting 2030 Strategy at a Capital Markets Day to be held in London in September 2023. Further details of this event will be provided in due course.

Get in touch

For further information please contact:

Hunting PLC

Jim Johnson, Chief Executive Bruce Ferguson, Finance Director Tel: +44 (0) 20 7321 0123 lon.ir@hunting-intl.com

Buchanan

Ben Romney Jon Krinks Tel: +44 (0) 20 7466 5000

Notes to Editors:

About Hunting PLC

Hunting PLC is an international energy services provider to the world's leading upstream oil and gas companies. Established in 1874, it is a premium-listed, public company traded on the London Stock Exchange. The Company maintains a corporate office in Houston and has its headquarters in London. As well as the United Kingdom, the Company has principal operations in Canada, China, Indonesia, Mexico, Netherlands, Singapore, United Arab Emirates and the United States of America.

From 1 January 2023, Hunting reports across five operating segments: Hunting Titan, North America, Subsea Technologies, Middle East and Africa (“EMEA”) and Asia Pacific.

Hunting PLC’s Legal Entity Identifier is 2138008S5FL78ITZRN66.