Results & reports

Recent and historic financial results and reports.

Full Year Results to December 31st 2025

View our Full Year Results 2025

2024 Annual Report & Results

View our 2024 Annual Report & Results.

Annual General Meeting 2025

This year's Annual General Meeting will take place on Wednesday 16 April 2025 at 10.30 a.m. in London, UK.

Financial highlights

Order book increased by 19% to $565.2m.

Revenue increased by 28% to $929.1m.

Non-oil and gas revenue increased 59% from $47.6m to $75.9m.

Gross margin improved to 25% from 24%.

EBITDA, ahead of previous guidance provided, and increased by 98% to $103.0m.

EBITDA margin of 11% up from 7%.

$83.1m of previously unrecognised deferred tax assets recognised at year-end.

Total dividends declared in the year of 10.0 cents per share, up from 9.0 cents in 2022.

Financial Summary

First table: Financial Performance measures as defined by the Group* Second table: Financial Performance measures as derived from IFRS

*restated

**non-GAAP measure

Revenue

Non-oil and gas revenue

EBITDA**

EBITDA margin**

Adjusted profit before tax**

Adjusted diluted earnings per share**

Free cash flow**

Total cash and bank / (borrowings)**

Net assets

ROCE**

Final dividend proposed

Non-cash goodwill impairment

Operating (loss) profit

(Loss) profit before tax

Diluted (loss) earnings per share

Net cash inflow (outflow) from operating activities

| 2024 | 2023 | Variance | |

|---|---|---|---|

| Revenue | $1048.9m | $929.1m | +$119.8m |

| Non-oil and gas revenue | $75.1m | $75.9m | -$0.8m |

| EBITDA** | $126.3m | $102.4m | +$23.9m |

| EBITDA margin** | 12% | 11% | +1pp |

| Adjusted profit before tax** | $75.6m | $50.0m | +$25.6m |

| Adjusted diluted earnings per share** | 31.4 cents | 20.3 cents | +11.1 cents |

| Free cash flow** | $139m | $(0.5)m | +$140.2m |

| Total cash and bank / (borrowings)** | $104.7m | $(0.8)m | +$105.5m |

| Net assets | $902.3m | $950.1m | -$47.8m |

| ROCE** | 9% | 6% | +3pp |

| Final dividend proposed | 6.0 cents | 5.0 cents | +1.0 cents |

| 2024 | 2023 | Variance | |

|---|---|---|---|

| Non-cash goodwill impairment | $109.1m | $nil | +$109.1m |

| Operating (loss) profit | $(21.1)m | $51.5m | -$72.6m |

| (Loss) profit before tax | $(33.5)m | $41.1m | -$74.6m |

| Diluted (loss) earnings per share | (17.6) cents | 65.9 cents | -83.5 cents |

| Net cash inflow (outflow) from operating activities | $188.5m | $49.3m | +$139.2m |

Operational and Corporate Highlights

Retain focus on global oil and gas opportunities, specifically growing international, subsea and offshore business

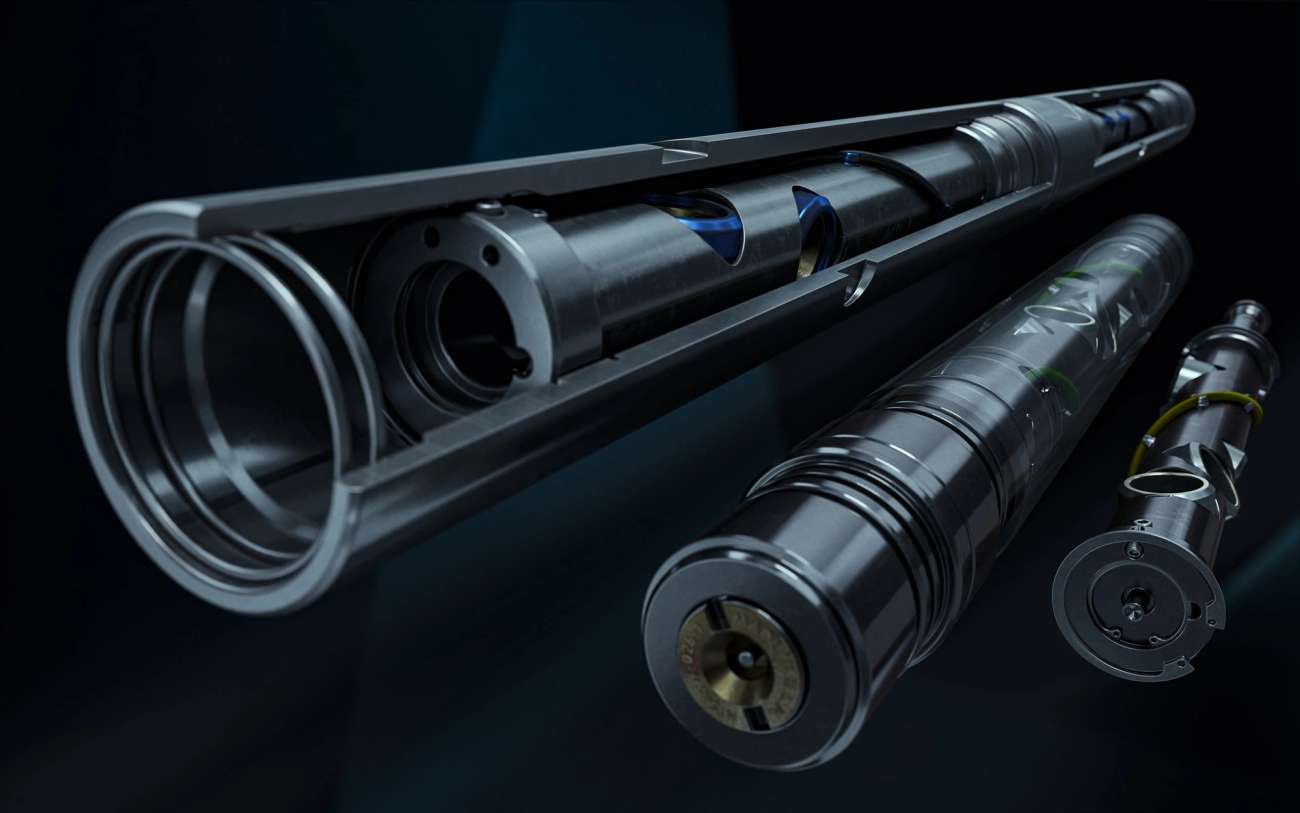

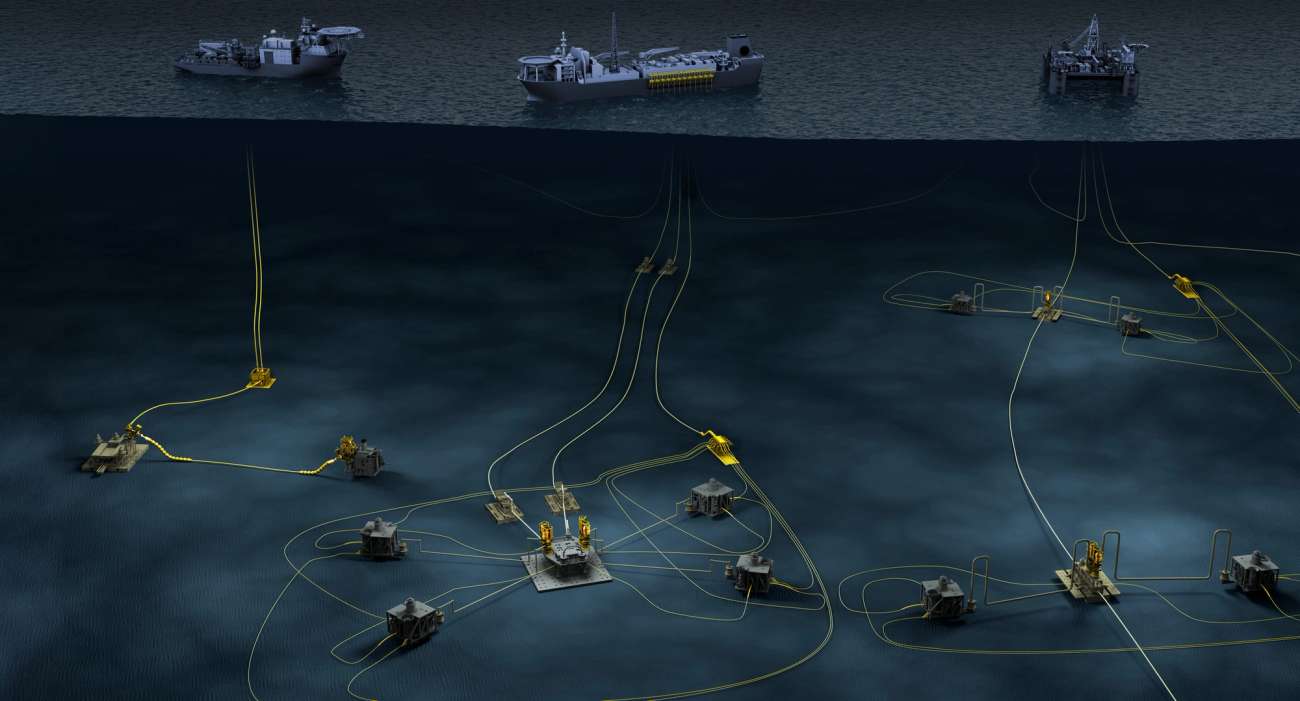

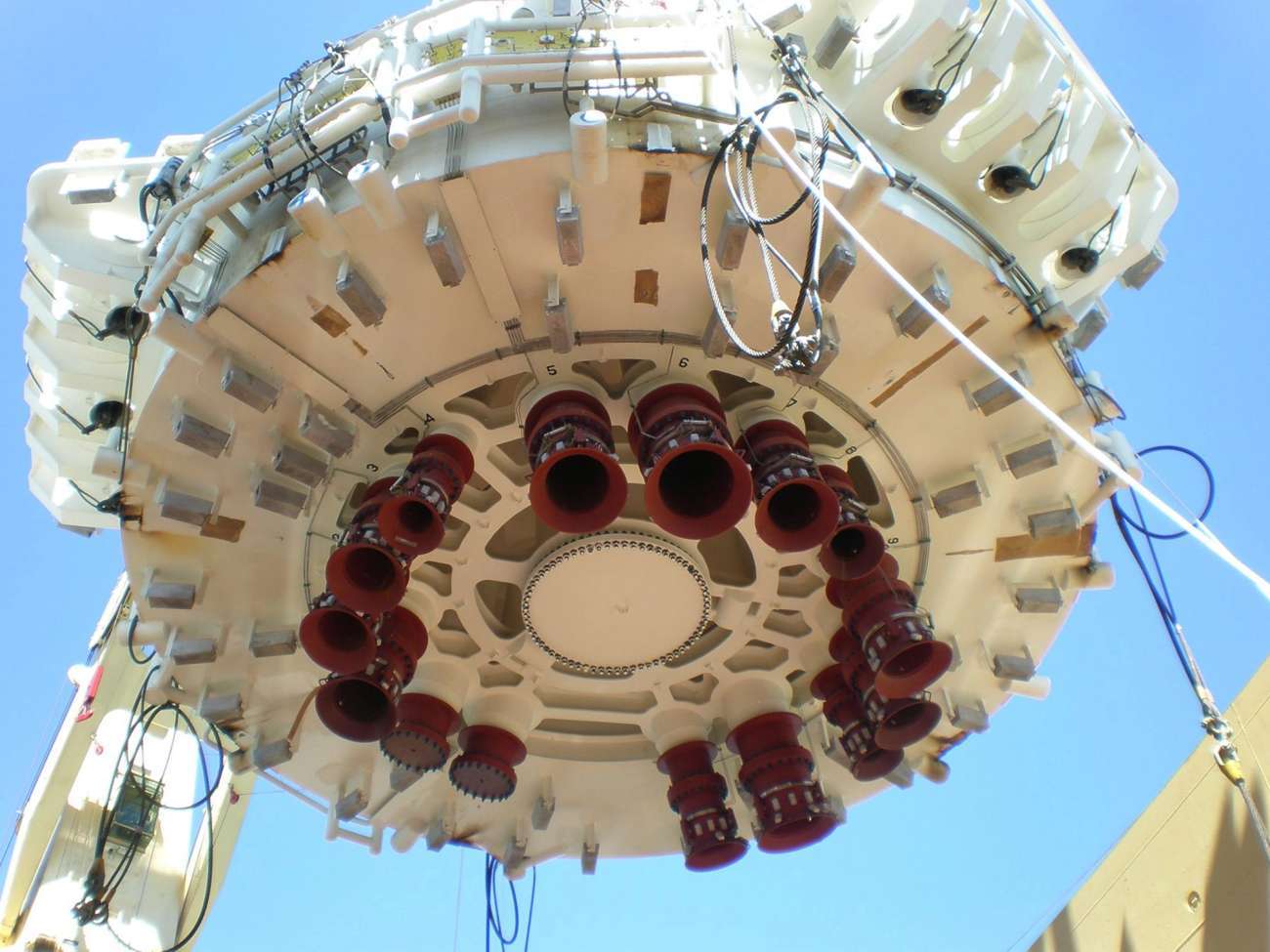

$231M OF CONTRACTS SECURED WITH KUWAIT OIL COMPANY Product group: OCTG In H1 2024, the Group announced the securing of record orders with KOC for OCTG threaded with Hunting’s proprietary SEAL-LOCK XD™ premium connection. The orders are a result of over five years of collaboration between Hunting, KOC and Hengyang Valin Steel in China to qualify the Group’s connections and OCTG raw material. The order commenced in July 2024 and will continue into 2025. CONTINUATION OF MAJOR ORDERS FROM EXXONMOBIL AND TPAO FOR HUNTING’S TITANIUM AND STEEL STRESS JOINTS Product group: Subsea Throughout 2024, the Group continued to execute on major orders for its titanium and steel stress joints (“TSJs”). The large orders for TSJs received in 2023 were worked on through the year for Guyana and the Black Sea. Orders were completed for the Yellowtail project in Guyana in the year, with work on the Uaru and Whiptail projects continuing into 2025. API THREADING LICENCE AT NASHIK, INDIA, FACILITY SECURED Product group: OCTG The Group’s joint venture facility in Nashik, India, received its API threading licence in May 2024, which will support new tender activity across India. Management anticipates that the addressable market in India is c.$300-$400m per year for OCTG and accessories manufacturing, with the Jindal Hunting Energy Services joint venture being an early mover in-country, as local content requirements increase to meet India’s growing energy requirements. FIVE–YEAR MANUFACTURING AGREEMENT WITH CHEVRON Product group: OCTG Hunting’s US OCTG business entered into a new five-year manufacturing agreement with Chevron in the Gulf of Mexico, which will support the OCTG product group to the end of the decade.

Deliver sales order book and revenue progress in non-oil and gas, energy transition and low carbon solutions

ORDERS WITH AN EXPECTED TOTAL VALUE OF $60M FOR LICENSED ORGANIC OIL RECOVERY TECHNOLOGY Product group: Other Manufacturing In August 2024, the Group received orders which, dependent on volumes and assumed extensions, could result in up to $60m of revenue for the deployment of its licensed OOR technology into the North Sea. The orders were secured with two major operators on the UK Continental Shelf and will be delivered over the next five years. $14.7M OF ENERGY TRANSITION SALES COMPLETED IN THE YEAR Product group: OCTG Hunting continued to win OCTG orders for geothermal and carbon capture projects in North America, Europe and Asia Pacific in the year. Orders for projects in the utility and agriculture sectors were won in the Netherlands, supporting Hunting’s long-term strategy of revenue diversification. STRATEGIC PARTNERSHIP EXPANSION WITH CRA-TUBULARS B.V. Product group: OCTG In August 2024, Hunting secured the exclusive sales, manufacturing, and distribution rights for $0.3m for CRA-Tubular’s novel titanium-lined carbon fibre tubing, which has strong long-term market growth opportunities in carbon capture projects in North America and Europe, for five years. The collaboration will enable the Company to accelerate further testing of tubulars and connections against key connection standards, which is being assessed by a super major. $0.9M INVESTMENT IN CUMBERLAND ADDITIVE Product group: Advanced Manufacturing In September 2024, Hunting invested a further $0.9m in Cumberland Additive, taking our interest to 30.7%, which will enable us to access 3D manufacturing opportunities across multiple sectors and applications.

Strong focus on long-term profitability of the Group

RESTRUCTURING OF THE HUNTING TITAN OPERATING SEGMENT Product group: Perforating Systems Over the last 12 months Hunting has delivered cost savings in the segment to align with the long-term outlook for the US onshore completions market. The Wichita Falls operating site and a number of distribution centres were closed in the year. In March 2025 as part of wider cost savings initiatives, further restructuring was announced which included a 5% reduction in headcount to deliver additional SG&A savings. RESTRUCTURING OF THE EMEA OPERATING SEGMENT Product group: OCTG With the further decline in North Sea oil and gas activity, primarily driven by UK political ambitions to decarbonise its energy supply chain, a restructuring of the Group’s EMEA operations was announced in January 2025. Annual cost savings are expected to be c.$8-$9m. EXPANSION OF MANUFACTURING IN DUBAI Product group: OCTG / Other Manufacturing During the year, the well testing product line continued its move from the Netherlands facility to Dubai together with Singapore’s well intervention product line to increase efficiencies and to be closer to our customers and pipeline of opportunities. EXPANSION OF COLLECTION OF GREENHOUSE GAS DATA Product group: All product groups The Group expanded its scope 3 greenhouse gas data collection to include the Subsea Technologies, EMEA and Asia Pacific operating segments following on from the collection of Hunting Titan’s scope 3 data for the first time in 2023.

Results archive

- Title Type XHTML Webcast File

Annual Report & Accounts 2024

Annual reportFull year reportView PDFHalf Year Report 2024

ReportPDFHalf Year Analysts Presentation 2024

PresentationListen PDFCorporate Presentation 2024

PresentationPDFAGM Presentation 2024

AGMPresentationListen PDFISS Proxy Response 2024

AGMPDFNotice of AGM 2024

AGMNoticePDFForm of Proxy 2024

AGMProxy formPDFPost AGM Shareholder Engagement Disclosure 2024

AGMPDFShare plan rules 2024

AGMPDF

- Title Type XHTML Webcast File

Annual Report & Accounts 2023

Annual reportView PDFFull Year Announcement 2023

ReportPDFFull Year Analysts Presentation 2023

PresentationListen PDFHalf Year Analysts Presentation 2023

PresentationListen PDFHalf Year Report 2023

ReportPDFResults of AGM 2023

AGMResultsPDFAGM Presentation 2023

AGMPresentationListen PDFForm of Proxy 2023

AGMProxy formPDFNotice of AGM 2023

AGMNoticePDF

- Title Type XHTML Webcast File

Annual Report and Accounts 2022

ReportView PDFFull Year Analysts Presentation 2022

PresentationListen PDFHalf Year Report 2022

ReportListen PDFHalf Year Analysts Presentation 2022

PresentationListen PDFResults of AGM 2022

ResultsAGMPDFAGM Presentation 2022

AGMPresentationListen PDFForm of Proxy 2022

Proxy formAGMPDFNotice of AGM 2022

NoticeAGMPDF

- Title Type XHTML Webcast File

Annual Report and Accounts 2021

ReportView PDFFull Year Report 2021

ReportPDFFull Year Analysts Presentation 2021

PresentationListen PDFHalf Year Report 2021

ReportPDFHalf Year Analysts Presentation 2021

PresentationListen PDFResults of AGM 2021

ResultsAGMPDFAGM Presentation 2021

PresentationAGMListen PDFForm of Proxy 2021

AGMProxy formPDFNotice of AGM 2021

AGMNoticePDF

- Title Type XHTML Webcast File

Annual Report and Accounts 2020

ReportPDFFull Year Report 2020

ReportPDFFull Year Analysts Presentation 2020

PresentationListen PDFHalf Year Report 2020

ReportPDFHalf Year Analysts Presentation 2020

PresentationListen PDFResults of AGM 2020

AGMResultsPDFForm of Proxy 2020

AGMProxy formPDFNotice of AGM 2020

AGMNoticePDF

- Title Type XHTML Webcast File

Annual Report and Accounts 2019

ReportPDFAnnual Report Presentation 2019

PresentationListen PDFHalf Year Report 2019

ReportPDFHalf Year Analysts Presentation 2019

PresentationPDFResults of AGM 2019

AGMResultsPDFForm of Proxy 2019

AGMProxy formPDFNotice of AGM 2019

AGMNoticePDF

- Title Type XHTML Webcast File

Annual Report and Accounts 2018

ReportPDFAnnual Results Analysts Presentation 2018

PresentationListen PDFHalf Year Report 2018

ReportPDFHalf Year Analysts Presentation 2018

PresentationListen PDFResults of AGM 2018

AGMResultsPDFForm of Proxy 2018

AGMProxy formPDFNotice of AGM 2018

AGMNoticePDF

- Title Type XHTML Webcast File

Annual Report and Accounts 2017

ReportPDFAnnual Results Presentation 2017

PresentationListen PDFHalf Year Report 2017

ReportPDFHalf Year Presentation 2017

PresentationListen PDFResults of AGM 2017

AGMResultsPDFForm of Proxy 2017

AGMProxy formPDFNotice of AGM 2017

AGMNoticePDF

- Title Type XHTML Webcast File

Annual Report and Accounts 2016

ReportPDFAnnual Results Presentation 2016

PresentationListen PDFHalf Year Report 2016

ReportPDFHalf Year Presentation 2016

PresentationListen PDFResults of AGM 2016

AGMResultsPDFForm of Proxy 2016

AGMProxy formPDFNotice of AGM 2016

AGMNoticePDF

- Title Type XHTML Webcast File

Annual Report and Accounts 2015

ReportPDFAnnual Results Presentation 2015

PresentationListen PDFAnnual Results 2015

ResultsPDFHalf Year Report 2015

ReportPDFHalf Year Presentation 2015

PresentationListen PDFResults of AGM 2015

AGMResultsPDFForm of Proxy 2015

AGMProxy formPDFNotice of AGM 2015

AGMNoticePDF