Specialty Acquisition

Hunting PLC (LSE:HTG), the international energy services company today announces completion of the acquisition of Specialty Supply L.P.

For Immediate Release 31 October 2011

HUNTING PLC

("Hunting" or "the Company")

Acquisition

Hunting acquires Specialty Supply for US$31.0m

Hunting PLC (LSE:HTG), the international energy services company today announces completion of the acquisition of Specialty Supply L.P.("Specialty"), for an initial cash consideration of US$31.0m (c.£19.5m).

The consideration paid is on a cash-free-debt-free basis and is subject to adjustment for working capital and will be funded from Hunting's existing borrowing facilities. An additional cash consideration of up to US$5.0m (c.£3.2m) is also payable on the achievement of certain performance conditions measured over a two year period. Specialty is the last of the three acquisitions, whose aggregate consideration amounted to around £90.0m, referred to in the announcement of the acquisition of the Titan Group on 5 August 2011.

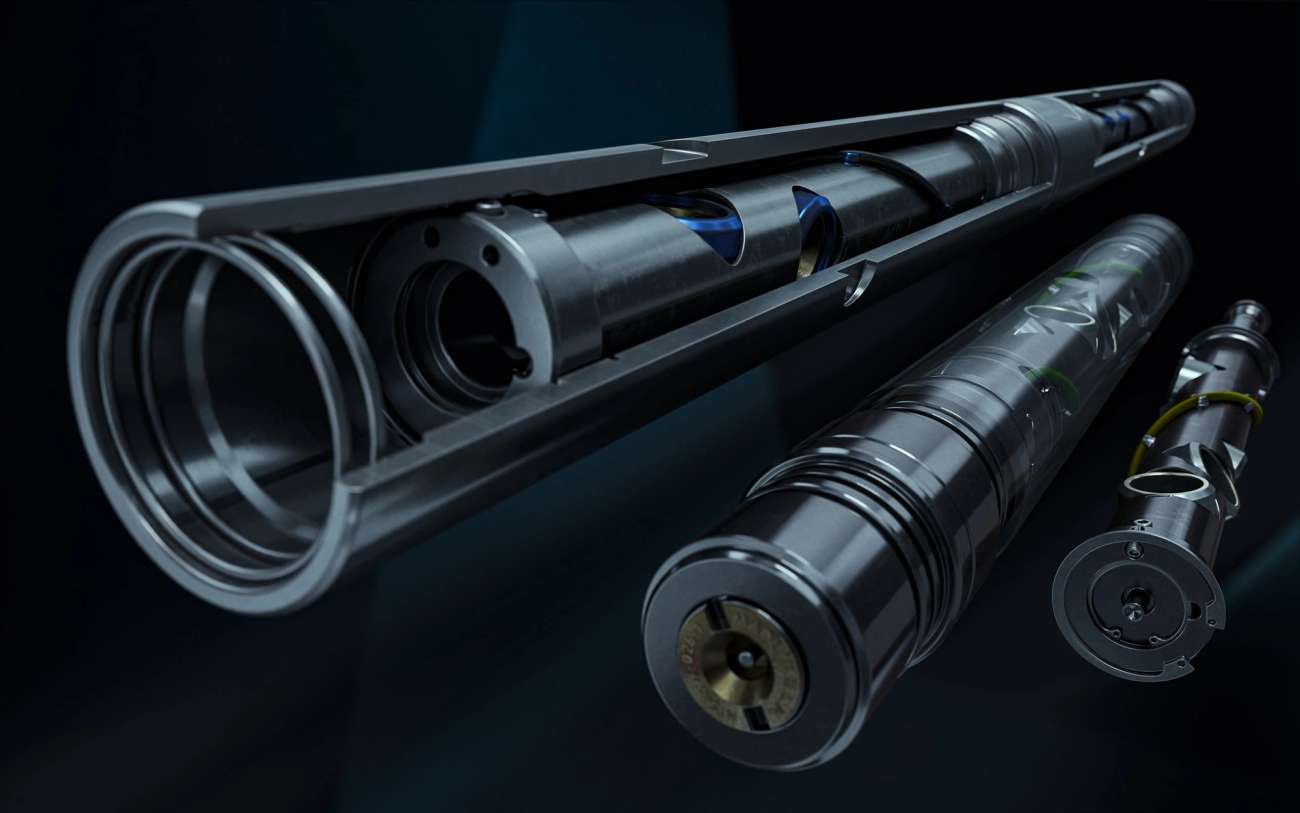

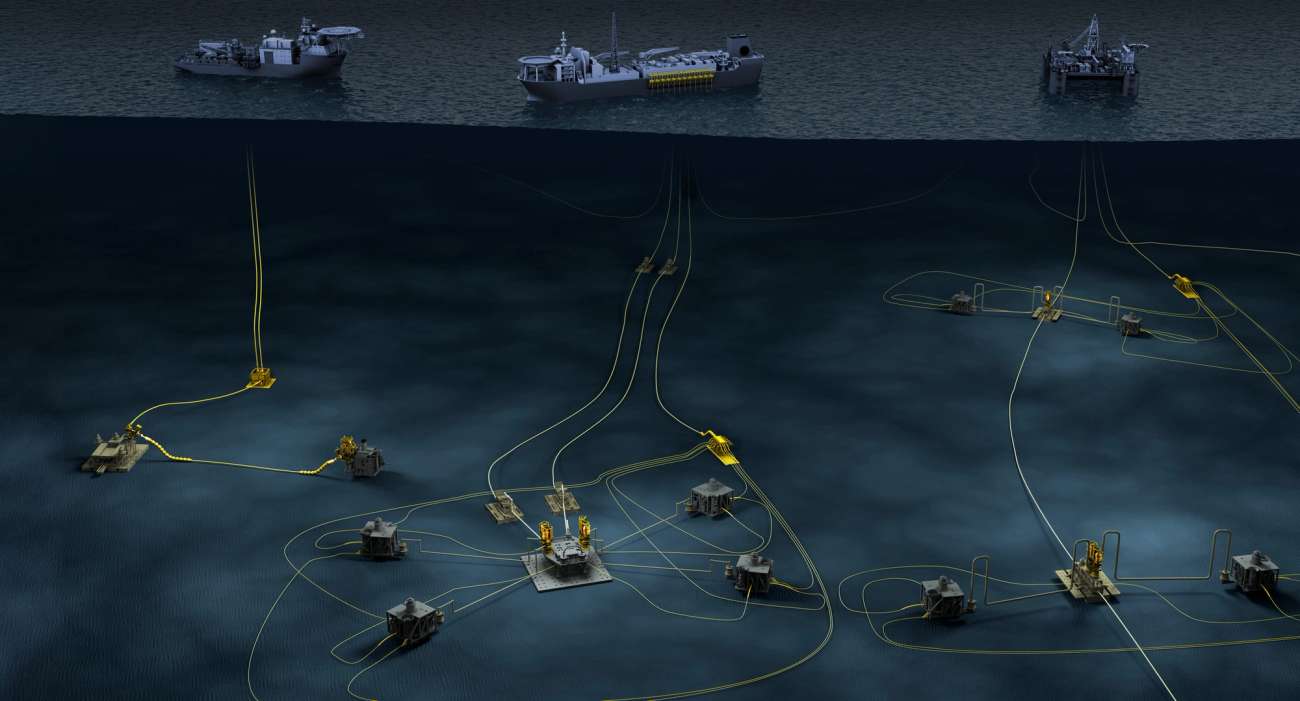

Located in Houston, Texas Specialty manufactures precision machined MWD parts used in directional drilling markets worldwide. These include a comprehensive line of running gear and associated products for MWD, LWD, steering tool and gyro systems. Additionally, Specialty's product offering includes drill pipe screens for all drilling applications as well as a complete line of downhole filter sub rentals.

Specialty was established in 2003 and operates from two production facilities totalling 32,000 square feet.

For the year ended 31 December 2010, under US GAAP Specialty generated revenue of US$17.7m (£11.4m), EBITDA of US$6.2m (£4.0m) and a profit before taxation of US$5.5m (£3.5m). Specialty's net assets and gross assets as at 31 December 2010 were US$6.8m (£4.3m) and US$9.4m (£6.0m) respectively.

Specialty has continued to perform well for the eight months ended 31 August 2011 with the unaudited US GAAP management accounts reporting revenue and EBITDA of US$17.6m (£10.9m) and US$6.9m (£4.3m) respectively.

The acquisition of Specialty is expected to be earnings enhancing in the first full financial year before acquisition costs and normal acquisition adjustments such as fair value adjustments and the amortisation of intangible assets.

Hunting is acquiring Specialty from the current management who will remain with the business following completion.

Commenting on the acquisition, Dennis Proctor, Chief Executive of Hunting said:

"Specialty has a broad customer base in the growing MWD market and provides Hunting with additional products and services in this area of oil and gas drilling. The business complements Hunting's Drilling Tools activities and will benefit from Hunting's operational footprint in key shale drilling regions.

"With the completion of the acquisition of Specialty and other recent transactions, Hunting provides many key products for MWD and LWD applications. Our strengthening portfolio in specialist manufacturing for complex conventional and unconventional oil and gas wells, positions the Group to provide products and services that enable companies to drill in demanding environments."

MWD/LWD - measurement-while-drilling / logging-while-drilling

For further information please contact:

Hunting PLC Dennis Proctor, Chief Executive Peter Rose, Finance Director +1 713 595 2950 +44 (0) 20 7321 0123

Buchanan Richard Darby Jeremy Garcia Gabriella Clinkard +44 (0) 20 7466 5000

Notes to Editors:

About Hunting PLC

Hunting PLC is an international energy services provider to the world's leading upstream oil and gas companies. Established in 1874, it is a fully listed public company traded on the London Stock Exchange. The Company maintains a corporate office in Houston and is headquartered in London. As well as the United Kingdom, the Company has principal operations in Canada, China, Hong Kong, Indonesia, Mexico, Netherlands, Singapore, United Arab Emirates and the United States of America.