Why invest

Hunting generates value through the manufacture of products, provision of related services and supply of rental equipment to the upstream energy sector enabling the extraction of oil and gas.

Investment proposition

Hunting PLC’s investment case is based on technology, engineering core competencies and a deep knowledge of the global energy industry. This expertise will drive long-term growth and leverage opportunities into new sectors that value these principles.

While the oil and gas industry is a highly cyclical industry, it touches every part of our lives from the clothes we wear to how we get to work. It is a sector that has a robust long term outlook, as it supports economic stability and growth across the world.

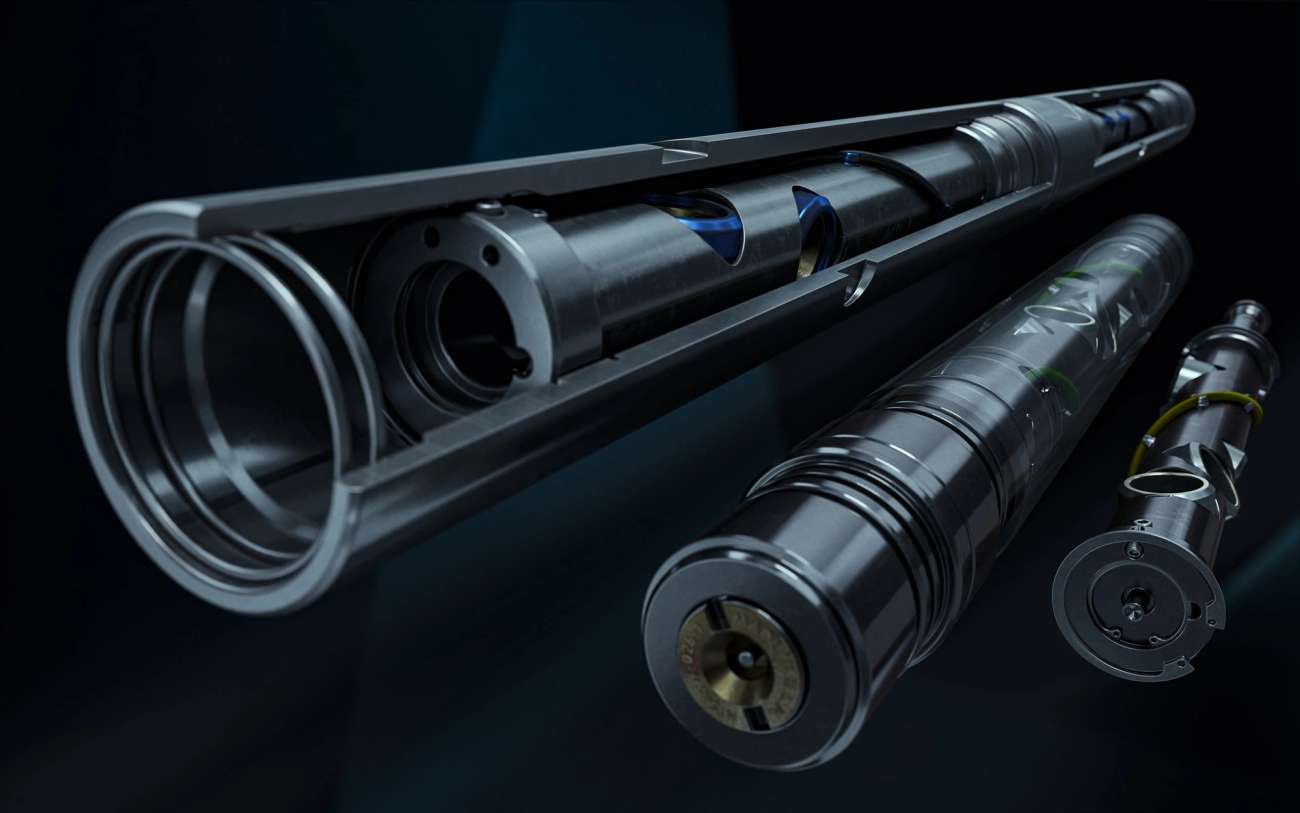

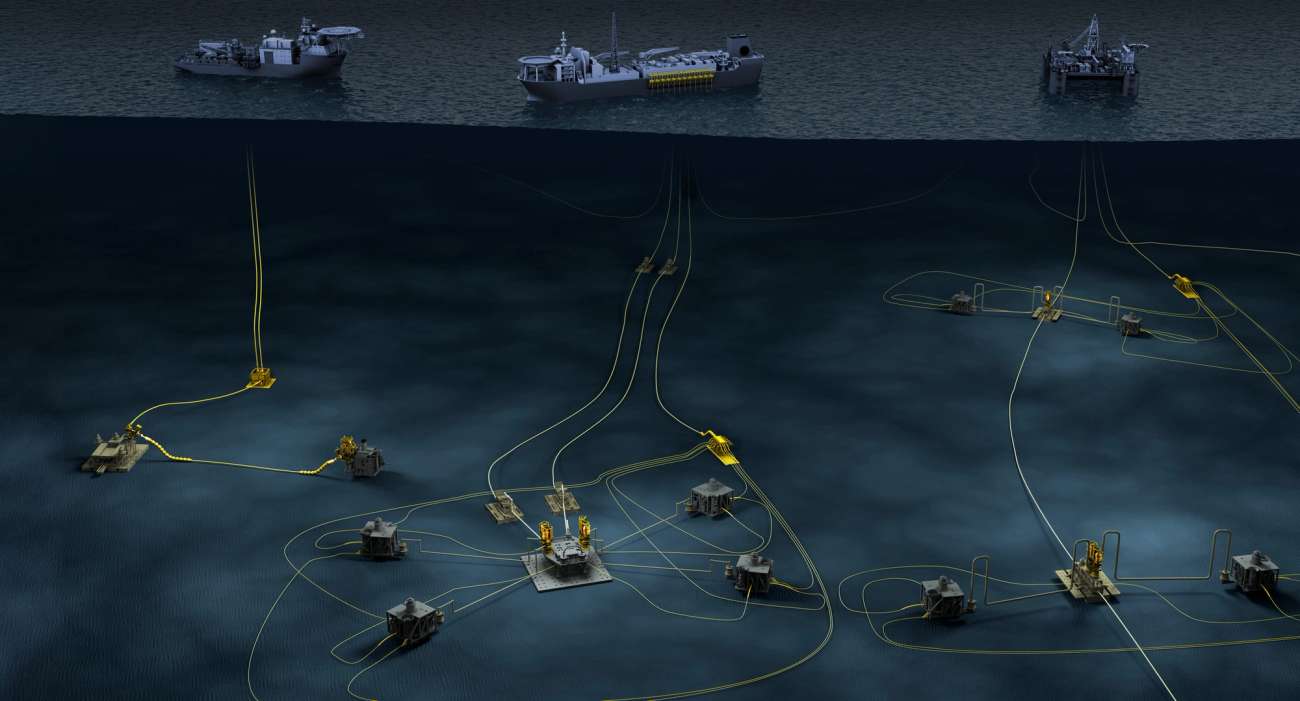

To deliver oil and gas responsibly, highly engineered equipment and robust services are needed. From a complex, onshore shale production well, to a deep-water, offshore exploration well, Hunting’s equipment is used to resolve many challenges within many different geologies to ensure the safe delivery of oil and gas to the end user.

Our technology offering ensures we maintain a leading market share in our key, chosen markets and often we protect this know-how through intellectual property.

Investor presentation with Q&A

Key stats

Our products are also applied to every part of the lifecycle of a wellbore, from the exploration phase and initial well construction, to completion and production, maintenance and well intervention and finally plug and abandonment, our portfolio supports all our customer needs.

Hunting’s facility footprint extends across 11 countries and four continents, with 29 manufacturing facilities and 14 distribution centres located in strategically important places, close to where our clients are developing new oil and gas resources.

Our business model is highly resilient, given the cyclical nature of the industry. All of our facilities have been configured to be cash positive on a one-shift manufacturing pattern, which allows the Group to navigate market shifts as the pricing of oil and gas moves.

11

Countries

4

Continents

27

Operating sites

16

Distribution centres

Our core competencies

Leadership in:

- Systems, design and precision engineering;

- Bespoke manufacturing; and

- Metallurgy and materials.

Investing in our people to provide:

- Innovation and a competitive edge, protected through patents and trademarks;

- Engineering and technical leadership to attract blue chip customers from multiple end-markets; and

- A premium service culture.

Global operating presence in key locations and exposure to high-growth markets with strong controls over:

- Quality assurance;

- Health and safety; and

- Carbon emissions.

Strong, experienced management team to:

- Pursue growth across complex and competitive sectors;

- Diversify revenue to ensure long-term resilience;

- Navigate through market cycles; and

- Ensure M&A targets are aligned with our long-term strategy.

Our strategic differentiators position us strongly

Diversified portfolio

Hunting has a diversified portfolio of market leading technologies, products and services that address many areas of the energy and non-oil and gas supply chain. The Group holds over 500 patents and trademarks across key technologies and geographies.

Efficiency

Our precision-engineered products are highly reliable and assist in higher safety protocols and more efficient procedures for our customers, wherever they are deployed.

Commercial agility

Hunting is able to leverage its world-class engineering and manufacturing capabilities into the energy transition sector and also into high quality non-oil and gas markets and industries through its global presence. Our commercial agility within the markets we serve helps us to remain a technology leader, often with a strong market share.

Our ESG principles

Hunting has a strong culture based on its highly skilled and trained workforce, resulting in strong quality-assured products and a robust HSE record. Our ESG principles help us drive growth and internal efficiencies, increase safety for both our workforce and that of our customers, and lower carbon emissions through operational effectiveness and technological innovation.

Our sectors of focus are resilient

Oil and gas

The global energy industry, particularly oil and gas, is a long-term driver of economic growth. This is likely to be the case for many years to come.

Energy transition

Energy transition opportunities are complementary to our core oil and gas markets, which is a further area of long-term growth for the Group.

Other non-oil and gas

Aviation, commercial space, defence, medical, and power generation sectors have long-term growth prospects. These are resilient markets that support economic prosperity and use our precision engineering expertise, which will reduce cyclicality in our earnings.

Our financial returns are gaining momentum

Strong growth profile

Hunting has increased its revenue, profits and cash flows as market conditions have improved across the year.

Improved margins

Stronger pricing and higher facility utilisation levels have enhanced operating margins and earnings, which have led to increased cash flows.

Improved earnings

Increased earnings have led to higher shareholder and capital returns in the form of dividend distributions and capital growth.

Cash generation

Consistently turning profit into free cash flow.

Strong balance sheet

- Improving balance sheet efficiency;

- Financial stability; and

- Asset Based Lending facility provides liquidity.

Progressive financial returns

- Revenue and profit growth;

- Fixed cost reduction strategy, delivering a more efficient business platform;

- Increasing EBITDA to free cash flow conversion; and

- Dividend growth.

Our business model

Hunting’s financial and operational resources enable us to leverage our core competencies in systems design and production, precision machining and quality print-part manufacturing. This allows us to add value for our stakeholders.

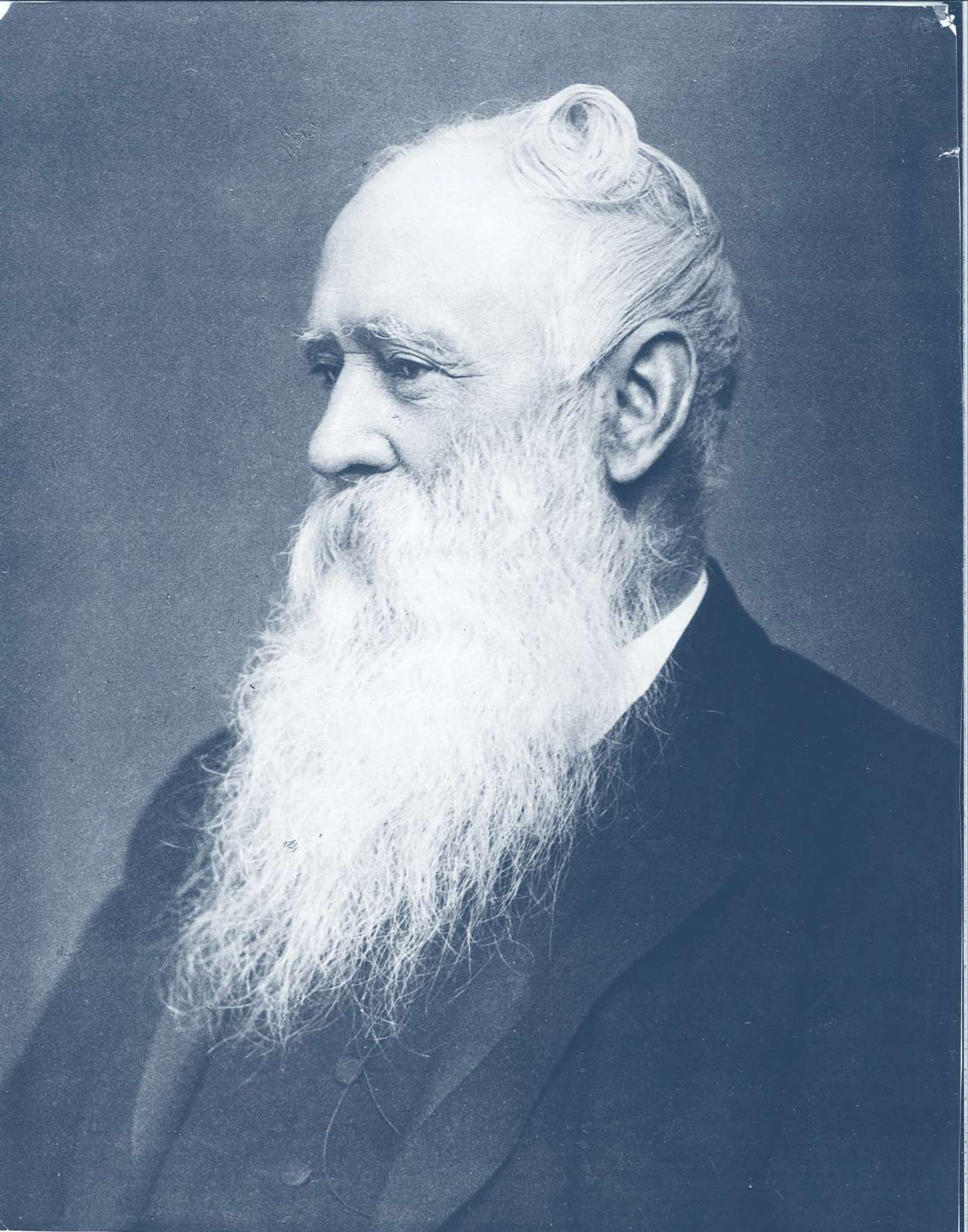

Company history

Change is our travelling companion; we have demonstrated endless resilience and willingness to embrace new industrial and societal contexts.

Entrepreneurial spirit has been ever present during our history, from the founding by Charles Samuel Hunting right through to today, where we are continually driving new possibilities for oil and gas extraction.

Board & governance

Our Group is managed and governed by a strong, experienced Board, who have expertise in the energy industry and other relevant sectors, with some of the world’s leading companies.

Hunting seeks to nurture and retain its workforce talent by offering competitive employment packages and training. We seek to maintain a resilient business model, and operating environment, and constantly seek ways to minimise our impact on the world. Efforts to reduce our carbon footprint are in place to ensure to responsibly for all our stakeholders.

Latest corporate governance reports

Hunting PLC is committed to high standards of corporate governance, corporate responsibility and risk management in controlling the business.

Committee reports

The Board has four main committees to which it delegates responsibility for the oversight and review of activities within its terms of reference. Find out more about their work in the reports.

Our sustainability framework

Our approach to sustainability can be illustrated through the following framework, which underpins our ambition to responsibly create long-term and sustainable value for all of our stakeholders.

In developing this framework, we considered the concerns and trends that shape our world, the business, social, environmental, regulatory and geopolitical imperatives affecting the Group, and the views and feedback of our key stakeholders.

ESG governance & reporting

Within the context of increasing ESG governance, our six key areas of focus are outlined here. As we progress our reporting journey, we will set and update our targets and KPIs for all these commitments, and will report them in more detail going forward.

Operating safely

Supporting and developing our people

Delivering innovative, high quality and reliable products

Fostering mutually beneficial partnerships

Supporting communities around us

Managing our environmental performance and mitigating our impacts

Sustainability at Hunting

Our commitment is reflected in our values, group policies and the relevant external principles and standards to which we adhere.