H1 2024 Trading Update

Hunting PLC issued its trading update ahead of the Half-Year Results, which will be released on Thursday, August 29, 2024. See below for full release.

Highlights

Sales order book at 30 June 2024 was c.$700m compared to $565m at 31 December 2023, supported by orders totalling $231m from Kuwait Oil Company (“KOC”).

H1 2024 trading has been ahead of management’s expectations driven by the strong performance in the Group’s OCTG, Subsea and Advanced Manufacturing product groups.

Perforating Systems reported headwinds in the period, leading to the implementation of a cost reduction programme that is projected to save c.$6m-$7m annually.

Good progress with Energy Transition strategy, with geothermal orders being secured in Asia Pacific, Europe and North America

EBITDA for the first half of 2024 is likely to be in the range of $59m-$61m - ahead of management’s expectations and c.22% ahead of H1 2023 and c.13% ahead of H2 2023.

EBITDA margin of c.12% (H1 2023 – 10%; H2 2023 – 12%) delivered in the period and remains on track to achieve 12-13% for the full year.

Balance sheet remains robust with total cash and bank / (borrowings) expected to be $(11)m-$(9)m at 30 June 2024, with a cash inflow of c.$23m in Q2, as cash generation increases.

Outlook

Outlook for the full year 2024 and 2025 is positive given the KOC orders secured, which will be recognised beginning in Q4 2024 through H1 2025.

Group performance for H2 2024 is projected to be ahead of H1 based on performance and cost reduction measures, therefore management is increasing EBITDA guidance for the 2024 full-year to c.$134m- $138m.

Management anticipates EBITDA to Free Cash Flow conversion to be c.50% for the full year and are targeting total cash and bank / (borrowings) at 31 December 2024 of between $30m-$40m.

Based on the quantum of the sales order book, which extends into 2026, management anticipates EBITDA to be in the range of $160m-$175m for the year ended 31 December 2025.

Capital expenditure for the full year 2024 is anticipated to be c.$40m-$45m.

Commenting on H1 2024 trading Update and the market outlook, Hunting’s Chief Executive, Jim Johnson, said:

“At c.$700m, our sales order book nears the highest in the Company’s history, which supports strong revenue and earnings visibility well into 2025. We are delighted to have secured the significant orders from KOC. This achievement is the result of over six years of collaboration with KOC, supported by Hunting’s industry leading premium connection technology, our strategic supply chains and our commitment to our clients to deliver value.

“Our business success has supported strong delivery of the Hunting 2030 Strategy. Management remains confident of delivering our EBITDA to Free Cash Flow target of 50% based on our expected financial performance for the remainder of the year."

Trading Statement

The Group’s sales order book is anticipated to be c.$700m at 30 June 2024, reflecting the material orders received from KOC in the period. The 2023 year-end sales order book was $565m. The monthly revenue run rate in H1 2024 is expected to be c.$82m, which compares to $79.6m in H1 2023 and $75.2m in H2 2023.

EBITDA in H1 2024 is expected to be in the range of $59m-$61m, including the Group’s share of associates’ and joint ventures’ results. Management anticipates an EBITDA margin of c.12% to be recorded in the period, which compares to 10% in H1 2023 and 12% in H2 2023.

Working capital has increased marginally in the period, however, total cash and bank / (borrowings) is projected to be c.$(11)m-$(9)m at 30 June 2024, as cash collections have improved through the second quarter, with a c.$23m inflow during Q2.

During Q2 2024, the Company has commenced purchasing its ordinary shares at a monthly rate of c.$1.0m for transfer to the Employee Benefit Trust operated by the Group to satisfy future share award vestings.

Sales orderbook

Revenue

EBITDAi

EBITDA margin

Total cash and bank / (borrowings)ii

i. EBITDA for H1 and H2 2023 has been restated to include the Group’s share of associates’ and joint ventures’ results

ii. Q1 2024 total cash and bank / (borrowings) $(34)m

| H1 2024 | H2 2023 | H1 2023 | |

|---|---|---|---|

| $m | $m | $m | |

| Sales orderbook | 700 | 565 | 530 |

| Revenue | 492 | 451 | 478 |

| EBITDAi | 59-61 | 53 | 49 |

| EBITDA margin | 12% | 12% | 10% |

| Total cash and bank / (borrowings)ii | (11)-(9) | (1) | (52) |

| i. EBITDA for H1 and H2 2023 has been restated to include the Group’s share of associates’ and joint ventures’ results | |||

| ii. Q1 2024 total cash and bank / (borrowings) $(34)m |

Outlook for 2024 and 2025

The outlook for the Group remains positive given the strength of international and offshore markets, which are the primary beneficiaries of global industry capital spend, which is driving momentum within Hunting’s OCTG and Subsea product groups, along with further progress within Advanced Manufacturing’s end-markets. Natural gas prices are expected to improve in the second half of the year across North America and into 2025 as LNG capacity is planned in the US which, if achieved, will support the outlook for gas-focused drilling. This should lead to a modest recovery within Hunting’s Perforating Systems product group, with shorter-term trading improvements to be driven by the cost efficiency initiatives noted below.

With the inclusion of the impact of the KOC orders, management now anticipates 2024 full year EBITDA to be in the range of c.$134m-$138m.

In the second half of 2024, management projects that working capital will reduce, driving an EBITDA to Free Cash Flow conversion for 2024 of 50% or greater. Year-end total cash and bank / (borrowings) is now targeted at c.$30m-$40m.

Capital expenditure for the full year 2024 is anticipated to be c.$40m-$45m. The Company continues to have the financial flexibility to undertake M&A where it can secure opportunities, which it believes will enhance its business both operationally and financially

Based on the anticipated timing of the KOC order fulfilment, whereby the majority of the revenue and EBITDA will be recognised in 2025, management anticipates full-year 2025 EBITDA to be in the range of c.$160m- $175m.

Product Summary

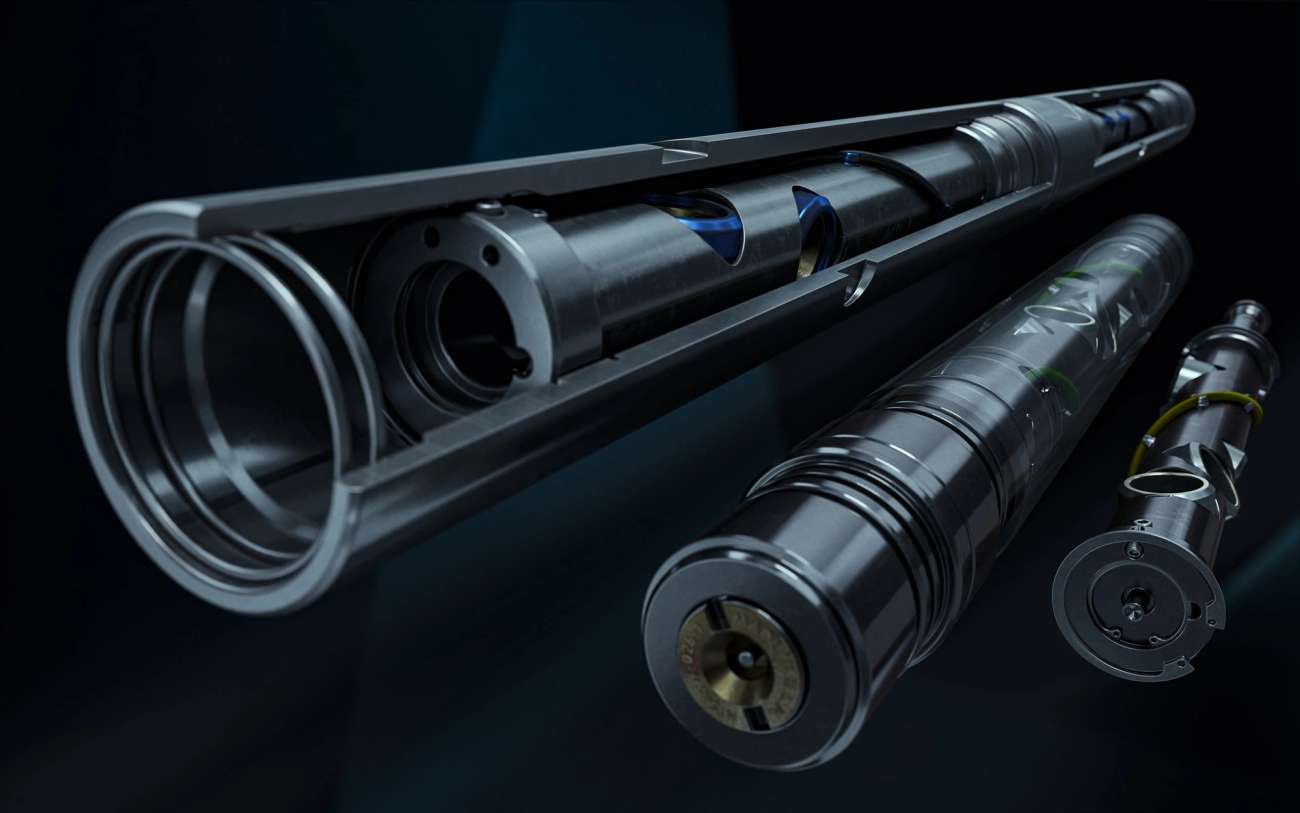

Hunting’s OCTG product group has recorded significant success during the reporting period, led by the two orders totalling $231m received from KOC, which were secured by our Asia Pacific operating segment in May 2024. In the US, demand for the Group’s TEC-LOCK™ connection has continued to increase, despite the weaker rig count, as market share gains in certain basins have occurred in the period. Overall, the Company’s global OCTG and Premium Connections offering has recorded strong success in the period, across Hunting’s WEDGE-LOCK™, SEAL-LOCK™ and TEC-LOCK™ connection families, supported by the continuation of accessories manufacturing for utilisation in Guyana and other international markets. The Group’s joint venture facility in India has secured its API licence in the period, which will enable the facility to participate in further tenders, with the JV’s backlog now extending into 2025. Hunting has also recorded progress in its Energy Transition strategy with OCTG supply contracts being secured in the US, Europe and Southeast Asia for a number of geothermal projects, including the US’s ‘Hell’s Kitchen’ development in California.

The Perforating Systems product group has reported trading headwinds during H1 2024, driven by industry capital discipline and the lower average natural gas price recorded across the period restricting drilling activity, which has led to a reduction in the US onshore rig count since the start of the year. Well completion activity, particularly in gas-focused shale basins, has reduced significantly with some oil-focused drilling also impacted as operators are unable to flare excess gas produced with crude oil offtake, which has led to the reduction in activity in the Permian basin. Partially offsetting this regional weakness is the strength of international sales totalling c.$23m in the period to regions such as Argentina and Saudi Arabia.

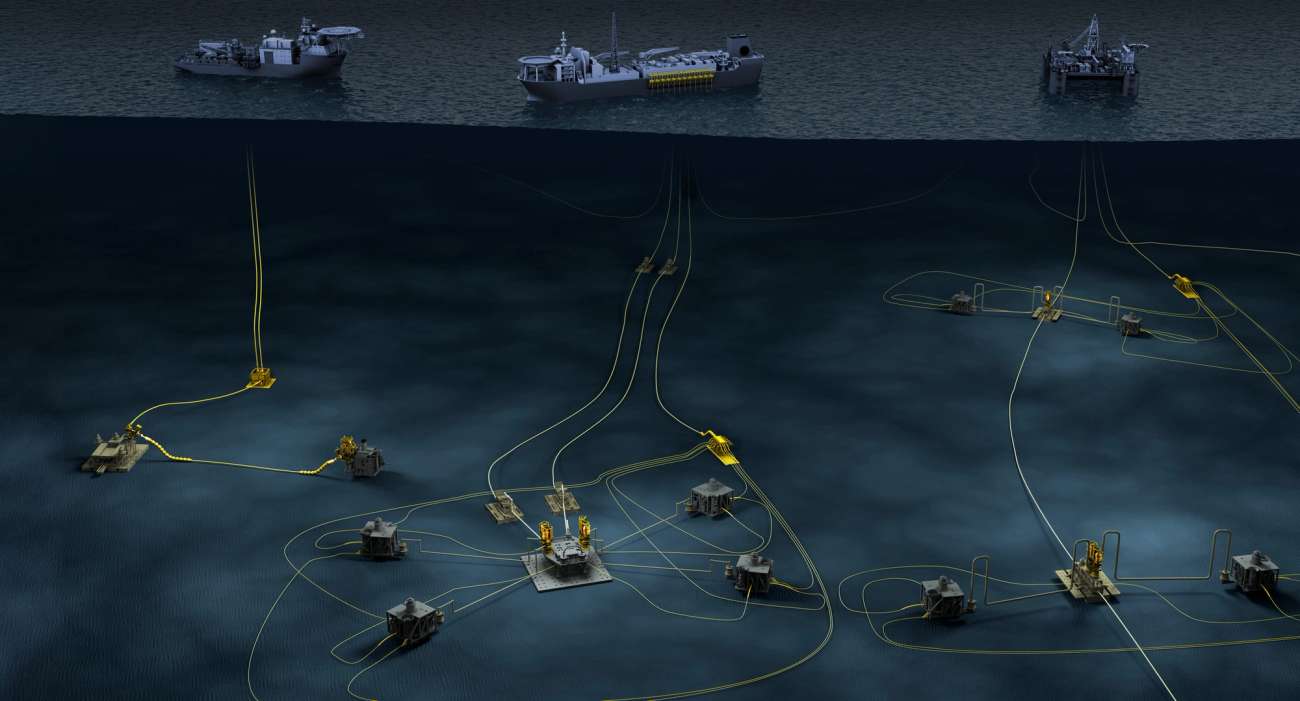

Hunting’s Subsea product group continues to report strong business momentum and performance, and during the period continued to deliver for projects in Guyana, with titanium stress joints for the Yellowtail project being shipped in the period. The Company’s hydraulic couplings and valves business has seen strong demand in the reporting period with a number of monthly sales records being reported in H1 2024. The Enpro Subsea business unit has seen an increase in its sales orderbook in the period, with new rental work being secured for its Flow Intervention Modules in Guyana. The product line reports strong bid activity across multiple regions, including South America and the Gulf of Mexico, and sees further longer-term growth from Africa where recent discoveries in Namibia and Mozambique will provide new, material opportunities for the Group. Overall, the product group is seeing solid financial performance and strong cash conversion from operating activities, with the 2024 performance likely to be more weighted to H1, due to the timing of order completions.

The Advanced Manufacturing product group has reported increased energy-related and non-oil and gas sales in the reporting period. The Electronics business unit has seen good demand for printed circuit boards to major energy services groups as well as demand for medical-related electronics in the period. The Dearborn business unit also reports good demand for its naval, power generation and aviation products, along with its energy-related sales. The Advanced Manufacturing sales order book remains solid, supporting a robust outlook for the second half.

Within Other Manufacturing, the Group’s Organic Oil Recovery Technology continues to be piloted on a number of wells across multiple reservoirs with large operators, enhancing oil recovery through the activation of microbial life within reservoirs.

Operating Segment Summary

As noted above, with the commentary on our Perforating Systems product group, the Hunting Titan operating segment has reported headwinds during the first half of 2024. Revenue is likely to be c.9% lower than in H1 2023, with EBITDA margins of c.2% reflecting lower activity in North America. Given the decline in performance of Hunting Titan, Hunting commenced the closure of the Wichita Falls operating site, with production being transferred to the Pampa operating site. Two distribution centres in Red Deer, Canada, and Marshall, Texas, are also being closed in H2, with sales being managed from other centres across North America. Hunting Titan has also completed a reduction-in-force programme during Q2 2024, with 92 positions being removed to align with current market activity. Annualised cost savings are likely to be c.$6m-$7m, with a c.$3m saving expected in H2 2024, which will contribute to an improved profitability in the second half of the year. Margins are expected to improve for the full year as the impact of the cost efficiency programmes are realised.

The North America operating segment has benefited from continued success with its OCTG and Premium Connections businesses as well as strengthening Advanced Manufacturing revenue, including non-oil and gas sales. Revenue is likely to be in line with H1 2023, with EBITDA margins projected to be c.15% reflecting higher facility utilisation and selected pricing increases across these product lines.

The Subsea Technologies operating segment has had a strong performance in H1 2024, as discussed above, and revenue is expected to be c.85% higher year-on year, with EBITDA margins expected to be c.22%.

The EMEA operating segment has reported mixed results, due to subdued activity in the North Sea, partially offset by stronger Middle East performance. Revenue is likely to be c.1% higher than in H1 2023, with EBITDA margins slightly below zero.

The Asia Pacific operating segment has delivered revenue of c.8% lower than in H1 2023; however, EBITDA margins of c.16% have been realised in the period as higher facility utilisation and stronger margin business has been captured. The performance of the segment will see a material step up in H2 due to the KOC orders being completed across the next four trading quarters.

2024 Half Year Results Briefing & Investor Meet Company

An analyst presentation in respect of the 2024 Half Year Results has been arranged for 9:00am (UK) on Thursday 29 August 2024, at the offices of CMS at Cannon Place, 78 Cannon St, London, EC4N 6AF.

An analyst presentation in respect of the 2024 Half Year Results has been arranged for 9:00am (UK) on Thursday 29 August 2024, at the offices of CMS at Cannon Place, 78 Cannon St, London, EC4N 6AF. After this, Hunting’s management will provide a live presentation via the Investor Meet Company platform on 29 August, commencing at 10:30am (UK). The presentation is open to all existing and potential shareholders. Questions can be submitted prior to this presentation via the Investor Meet Company dashboard up until 9:00am the day before the meeting or at any time during the live presentation. Investors can sign up to Investor Meet Company for free and add to meet Hunting PLC at Register Investor - InvestorMeetCompany

Investors who already follow Hunting on the Investor Meet Company platform will automatically be invited.

Get In Touch

For further information please contact:

Hunting PLC

Jim Johnson, Chief Executive Bruce Ferguson, Finance Director Tel: +44 (0) 20 7321 0123

Buchanan

Ben Romney Barry Archer Tel: +44 (0) 20 7466 5000

Or

lon.ir@hunting-intl.com

Notes to Editors:

About Hunting PLC

About Hunting PLC Hunting is a global engineering group that provides precision-manufactured equipment and premium services which adds value for our customers. Established in 1874, it is a premium listed public company traded on the London Stock Exchange. The Company maintains a corporate office in Houston and is headquartered in London. As well as the United Kingdom, the Company has operations in China, India, Indonesia, Mexico, Netherlands, Norway, Saudi Arabia, Singapore, United Arab Emirates and the United States of America.

The Group reports in US dollars across five operating segments: Hunting Titan; North America; Subsea Technologies; Europe, Middle East and Africa (“EMEA”) and Asia Pacific.

The Group also reports revenue and EBITDA financial metrics based on five product groups: OCTG, Perforating Systems, Subsea, Advanced Manufacturing and Other

Manufacturing. Hunting PLC’s Legal Entity Identifier is 2138008S5FL78ITZRN66.